How The Global Race For Car Battery Materials Is Changing Mining

With the Russian invasion of Ukraine in February 2022, alongside the obvious humanitarian issues, a huge shock was also felt across commodity markets, with far-reaching consequences for the mining sector. Russia is the world’s third-largest nickel producer and eighth-largest producer of copper.

Under the ever-changing lens of geopolitics and ESG shifts, AMC’s world-leading

mining consultants explore how the global race for

raw materials for electric vehicle battery supplies is changing mining as we know it.

The effect of Russia’s invasion on the global commodity market

Mark Chesher, Executive Leader Business Development and Principal Mining Engineer at AMC Consultants, explains the likely long-term consequences of the invasion of Ukraine on global electric car battery raw material production and prices.

Chesher believes the war will contribute to a short-term deficit in copper supply. As for nickel, Norilsk is one of the major mining houses in the world, with approximately 10% of the world's nickel supply. “Supply contracts take a long time to work through the system. But if the sanctions are applied strictly, it will bite hard in the metals market across the world.”

Metallurgist and Technical Manager - Business Development, Rob Chesher, says that Russian nickel projects are well-developed for growth and taking them out of play for the foreseeable future will have consequences. “We talk a lot about ‘prospectivity’ – projects that are being developed further into the future, but they are currently in the study or early study phase. There are many targets following these trends throughout Eastern Siberia.”

Nickel and copper mining in Africa and Asia - new exploration

A race for new

electric vehicle battery raw materials exploration is therefore now underway.

Central Asia

Kazakhstan has significant copper production and abundant reserves of other minerals – primarily zinc. Despite prospectivity in that part of the world, it remains relatively under-explored and could therefore push the case for more investment in the Central Asian area.

Pakistan

This country could become a key producer through the recent announcement of a partnership between Barrick and the federal and state Pakistan governments.

Southeast Asia

This region also sees significant projects along the Pacific Rim, with the Philippines being a very important area for future production. Indonesia also remains important, but this is caveated by more prohibitive legislation and political challenges, which means it takes longer for projects to come to fruition.

South America

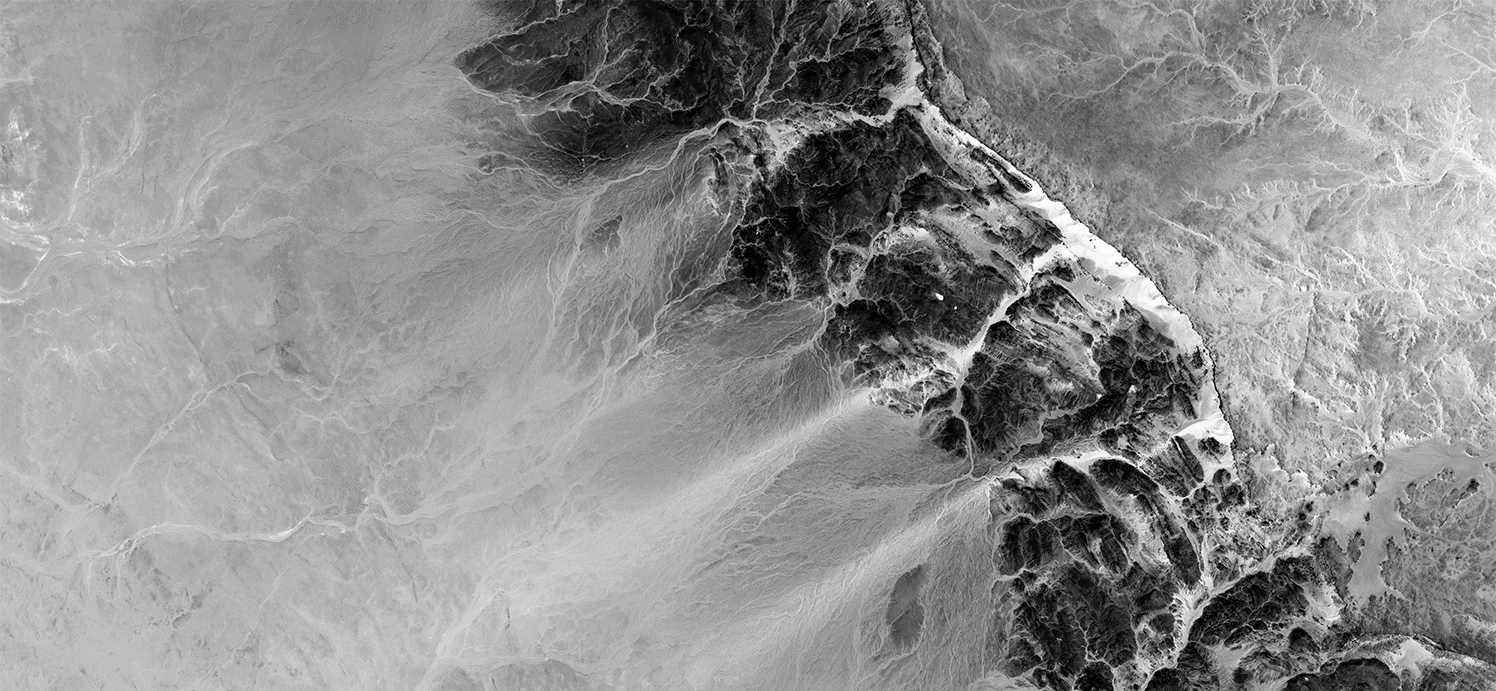

The big producers are Chile, Brazil, and Peru. However, while commodities may be in rich supply in these regions, mineral deposits are often found in the middle of a rainforest, up a mountain, or in areas only accessible by river transport.

We're likely to see an increase in brownfield expansion. Given large greenfield projects take 10-15 years for development and can take up to 25 years to get into production, there will likely be two speeds that unfold. One is finding metal that is for the long term, and the other is to satisfy this immediate gap. This direction will therefore likely drive existing open pit operations to bigger pits or to transitioning underground to increase or extend production from existing operations.

Electric car battery raw materials & a copper deficit

Copper mine production is not keeping pace with current increases in demand. New demand created by electric vehicles (EV) is increasing, and the market appears set for a large deficit, exceeding what has been observed over the last five years or so. In the short term, the prognosis is bleak.

Thanks

The copper stockpile situation looks set to worsen. Reversing this trend will require a significant increase in spending on exploration, project studies, and new mine development. Improved copper recycling rates are likely to assist in the longer term, but the immediate need is unlikely to be met by scrap recovery due to the long lifecycle of most copper-intensive products.

The effects of geopolitical events on car battery mining

The mining sector must learn to mitigate against geopolitical events exacerbating the price increase in

raw materials used for electric car batteries. This includes:

- Better due diligence and a higher focus on the risks to achieving project success. Ranking new production in terms of not only cost of production but risks across the whole project.

- Price increases will become entrenched, giving investors the confidence to put more money into projects so that they can assess the risk and then mitigate through dialogue with governments, local authorities, and local stakeholders.

- Localised risks, such as those seen in South America with issues concerning water supply. It may be that you can develop a project, but you need to invest additional money and infrastructure to ensure local interests are considered.

However, good companies in this sector are fundamentally values-driven. Well-managed companies that have strong values can take on difficult projects.

Improving mining industry profit margin

The production cost of electric battery minerals is starting to rise significantly, so how will this surge threaten to push up prices?

In the copper industry, the price is currently around US$4.00 a pound – double what it was a year or so ago. But in that same two-year period, the price of gold has gone nowhere. If you happen to be in a sector of the industry that has not seen any increase in price, then you're in trouble because the production costs have started to go up already. Moreover, the cost of producing copper involves not just labour, but also transport and power costs.

Drivers of commodity prices are different from those for base metals, which are driven by supply and demand in the

EV battery market. AMC’s Advisory division focuses not just on reducing an operator’s cash cost position but improving their productivity and cash flow to improve their margins.

Rethinking exploration of electric battery materials

Despite nonferrous exploration budgets being globally down now, there must be an increase in exploration and resourcing. Everything points to an increase in the gap between electric car battery minerals supply and demand. As a society, for the last 30 or 40 years, we've been used to inflation being driven by demand. But this is now a supply-driven problem.

In general terms, the easy mining has already been discovered. So, not only is less money being spent but there is less success in finding projects with that money. A rethink about exploration will drive the industry towards parts of the world with a history of being ‘riskier’ – countries such as Iran, Zambia, Zimbabwe, Tanzania, and the DRC.

In addition, a fundamental change in the environment of those countries is required to make sure it's a jurisdiction that can be worked in readily. The industry needs to be operating in an ethical fashion and abiding by the international principles that are in operation. It also needs to work with the governments and local populations to ensure that the production benefits everybody.

For additional in-depth reading, AMC explores substitute materials and the state of the Australian lithium-ion batteries market in this article about the

influence of geopolitics on battery material exploration.

ESG mining (Environmental, Social, and Corporate Governance)

This kind of approach has also seen something of a mining renaissance in countries such as the US and Canada as operators strive to show ethical practices and solid ESG credentials. Areas that have historically provided a lot of the metals are now demonstrating that they can be mined ethically.

As such, we're likely to see big projects in Southwest USA (where there are several copper projects involving AMC), Alaska and Canada. However, many are concerned that given the pressures the industry is currently facing, ESG may again be nudged out of the limelight.

Car battery mining industry revenue and costs

Andrew Hall, Director / Executive Lead - Advisory of AMC highlights an overuse of simplistic measures. He says that typically mines are tied to achieving production targets, and in the short-term options may be limited in terms of changes to capacity and scale. So mines should be looking to make the most money from existing capacity.

“Consultants that have a deep understanding of how mines make money can be more surgical in their approach. They’ll target the areas that need attention, shifting away from one-size-fits-all unsustainable cost-cutting to instead resolving those issues causing high unit costs and low mineral production in the first place, and it will be more sustainable,” says Hall.

Contact AMC Consultants for smart mining solutions

With a holistic view of the entire mining value chain – and expertise in the core competencies of resource development – AMC is proving invaluable for our customers. Using our independence to help guide the industry as much as possible to meet community expectations, obligations and guidelines is paramount.

Being a consultant-owned company is a strength and means AMC is independent in thought. Whether your business is focused on mining

minerals in electric car batteries or other commodities, tap into our expertise and skills today - reach out to our team for an initial consultation.

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights