Five Key Levers to Improve Margins and Beat the Cost-Price Squeeze

This article is based on a keynote presentation delivered by Andrew Hall, Director / Executive Lead Advisory, at the IMARC 2022 conference and focuses on five key levers to improve margins, and beat the cost-price squeeze.

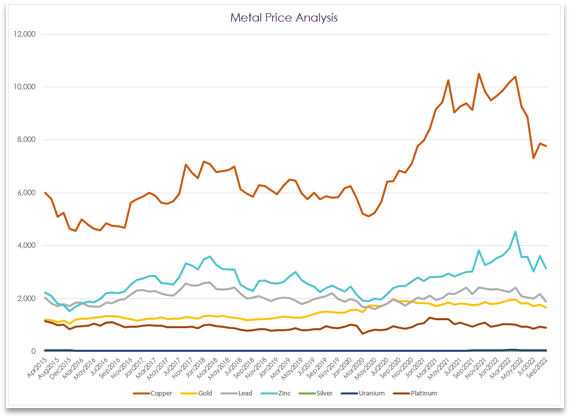

The high metal prices that have prevailed for most of the last decade have triggered a chase for production. This has compounded the fundamental scarcity in some key inputs, such as experienced and skilled labour, and has been pushing costs up over time. But recently, this has been accelerating, due in part to Covid-locked borders and supply chain issues, geopolitical factors such as war, and most recently sky-high inflation.

We are now seeing the prices for many minerals, while still relatively high, come off their recent peaks. The combined effect of increased costs and lower prices is squeezing margins.

Five Key Levers

I’ve been in the mining industry for over 25 years, and this certainly isn’t the first time in my tenure that similar challenges have arisen. What we see time and again is that the use of blunt instruments such as cost cutting and intensive productivity improvement programmes, barely scratch the surface. They may deliver some short-term gains but these are rarely sustained. The big opportunities are typically found by digging a little bit deeper into the key levers of performance to uncover the hidden value by mining smarter.

These opportunities typically don’t require big investment but do require a more sophisticated approach. The five key levers that can drive sustainable performance improvement address both sides of the cash flow equation, that is costs and revenues. Miners can improve cash margins and reduce business risk by:

Employing good cost management and control, rather than cost cutting, will typically result in significant savings that can be sustained. The difference being that a deeper understanding of cost drivers can quickly identify and eliminate wastage and inefficiency without compromising quality or sustainability.

- Getting the most out of the available data provides a substantial opportunity to improve productivity and performance. But to do this it’s essential to set the right KPIs to get data working for you.

- Developing a robust geometallurgical model is another key lever that results in more predicable ore and enables higher recoveries and reduced cost.

- Reviewing the cutoff grade policy and moving away from a break-even grades typically results in higher cash margins today, to buffer against the challenges we are currently facing, and maximizes value over the long-term to de-risk the mine.

- Good mine planning ensures you have a sound strategy and that you are achieving your business goals.

These five key levers are relatively low-cost to implement, but will typically drive a significant uplift to the bottom line. And while this is particularly important when margins are under pressure, anytime is a good time to do initiate them.

Cost management and control

There is always temptation to cut costs fast and hard when under margin pressure. While short-term cost reductions are often achieved, they are rarely sustained. This is because most costs are associated with having and maintaining capability and capacity, and typical cost-cutting approaches reduces one, or both, of these critical enablers of performance. So lazy ‘cost-cutting’ approaches tend to identify and target longer-term activities such as waste development and overburden removal, which aren’t essential to short-term production, but eliminating them will affect the mines future ability to achieve its targets.

Consequently, we see that cost cutting measures are generally not effective and have to be reversed over time. But costs have been increasing alarmingly and something needs to be done. AMC’s SmartDataTM shows that on average underground mining costs have been rising by over $1.50 per ore tonne per annum above inflation for the past decade. Similarly, open pit costs have been increasing by $1 per tonne mined per annum above inflation, in recent years. The overall impact is that unit mining costs at many mines have doubled in the last five years. While some of the cost increase can be explained by mines getting deeper most is due to mines paying the price for expanded production to increase metal output, as well as rising input costs, which look likely to continue for a while yet.

More than 20 years of experience in cost estimation and undertaking benchmarking studies at mines all around the world has led me to the observation that most mines don’t have a good understanding of their costs. And not enough emphasis is placed on management accounting with too many costs being allocated too early within accounting systems which reduces transparency and understanding, and often leads to the type of flawed short-term decisions described earlier. Fixing this isn’t hard but you need to know what you are doing and understand how a mine works.

Understanding costs, enables better control. Budgets should be prepared as bottom-up, direct-costed, first-principles estimates. Cost elements are used to build-up activity costs, and then the activity costs are integrated with the relevant cost driver to estimate total costs. This needs to be done at a detailed level so the costs are accurate for each activity i.e. different development profiles.

Once the budget estimates are accurate, the next step is to ensure the chart of accounts is structured to accurately capture costs at the equipment or functional level before allocations are made to relevant activities. Unfortunately, most accounting systems are set-up for financial accounting rather than management accounting so changes to the chart-of-accounts may be necessary. But even if you can’t change the chart of accounts, with a little bit of work and mining nous the costs can be exported at an elemental level and restructured appropriately, this is what we have to do for every benchmarking study we undertake.

Once complete more accurate budget estimates can be calibrated to actuals and thorough auditing and reconciliation can be undertaken. This enables the quick identification of cost variances and the root cause of wastage and inefficiency. Good cost management and control is a far better approach, both in the short and longer term, rather than the blunt instrument of cost cutting, and it enables wastage and inefficiency to be targeted with precision.

Getting the most out of your data

New technologies allow us to continuously measure operations to ever-increasing levels of accuracy and gather massive amounts of data in real time. But if the data isn’t used to support good decision making and improve what we are doing, then at best it becomes a distraction and at worst leads to incorrect and flawed decisions.

When AMC first started benchmarking mines over 25 years ago the available data was limited and the quality was often poor. Now nearly all mines have real time data gathering, providing accurate ‘live’ records of where equipment is and what it is doing, continuously flooding onto the mine’s servers.

But does this lead to a better understanding of how the operation is performing? And does it lead to better performance Evidence suggests not.

Over the past two decades AMC’s Smartdata™ shows that the main driver of increased productivity and production has been bigger and more powerful equipment. But equipment operating hours and non-productive time have not materially changed in open pit or underground mines in the past 20 years. In underground mines, on average, the non-productive time for Jumbo’s and long-hole drills is 60% of total calendar hours. For LHD’s and trucks 35% of total calendar hours is non-productive. In open pit mines the average non-productive time for production drills is 30%, while the non-productive time for trucks and loaders is approximately 25% of total calendar hours.

So, despite the shift to the ‘digital mine’ the information is not being used effectively to impact on a great opportunity, reducing non-productive time in the mining cycle.

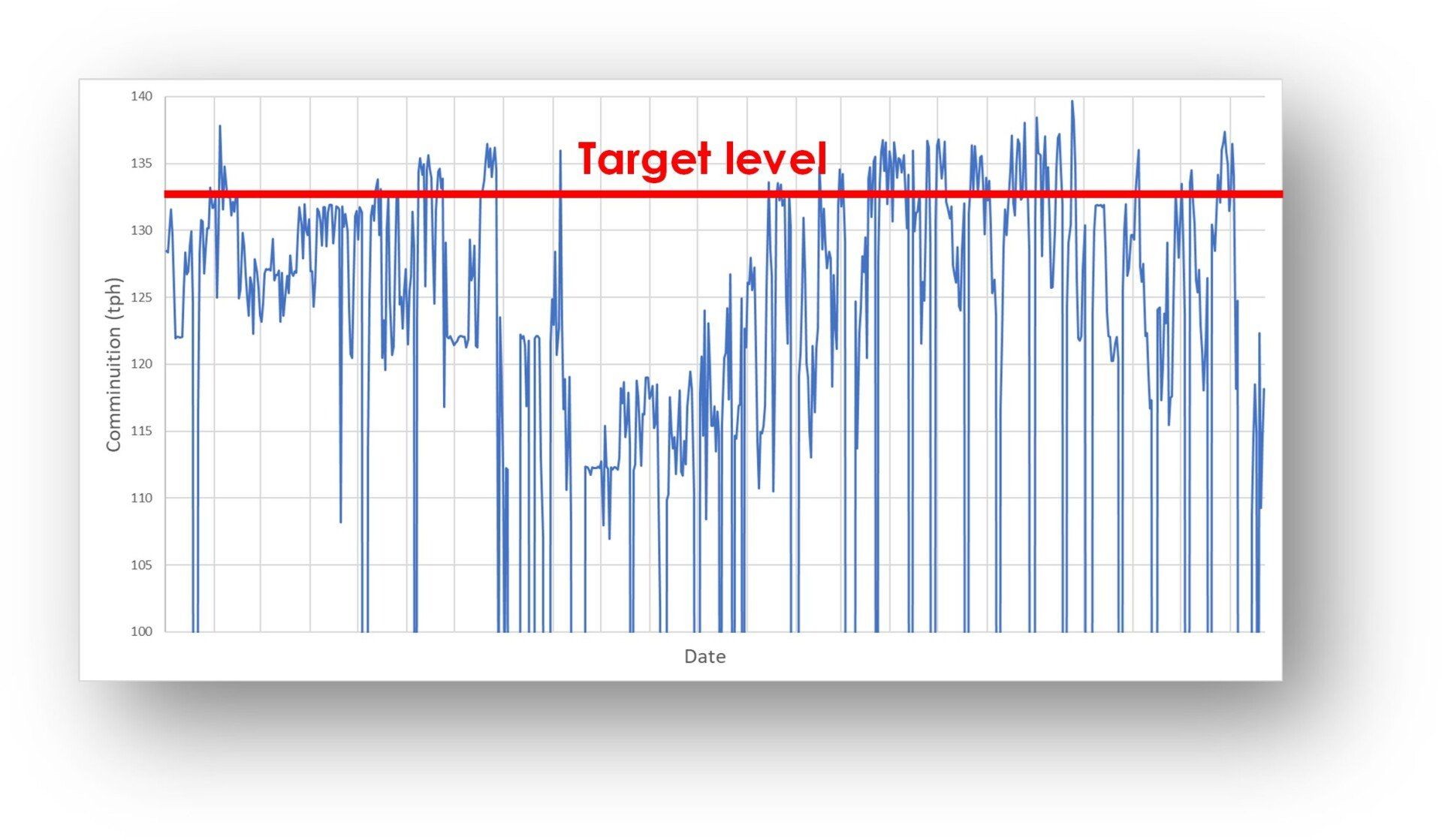

Why? Well, it comes down to having the right KPIs. To effectively monitor mine performance KPIs need to be holistic and link each activity to the overall performance of the mine. At present most mines use too many simplistic KPIs that don’t adequately link the different activities in the mining cycle. The data too often becomes the KPI and trying to optimize individual activities in short time increments is driving poor decisions. The result is that non-productive time hasn’t improved.

So what are the right KPIs? In my opinion the most important is compliance with the plan but I will talk more about that later. The critical KPIs that are often not adequately measured are leading indicators such as ore stocks levels. Maintaining adequate stocks such as drilled, broken, ROM, and exposed ore, as well as the long-term stock levels such as capital developed stocks, buffer interdependent activities, and increase the ability of equipment to work.

High performing mines consistently and predictably achieve their targets. And they do this by evaluating the performance of the whole mine by focusing on the right leading & lagging KPIs and understanding the links between the different activities that will enable them to reduce variance, be more productive, and achieve their targets.

Using the right KPIs shifts focus onto doing the right things to deliver the desired overall performance. This in turn enables an operating environment that supports high performance. Data and metrics are useful but they must be used to inform the right KPIs and not become KPIs themselves.

Geometallurgy

Everything that happens in a mine depends on the orebody. And yet, many mines still lack a deep understanding about the mineralization prior to extraction. By leveraging the right data, orebody knowledge can be used to improve everything from grade control to metal production.

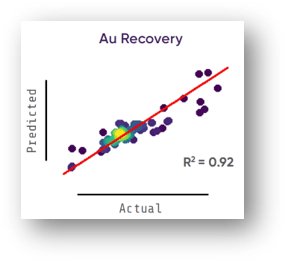

Predictive Geometallurgy is a proven process that leverages geology, metallurgy, data science and machine learning to produce a 3D block model of the orebody which captures the response of ore to mineral processing. While the natural variability of the orebody can’t be changed, Geometallurgy enables the most thorough understanding of the orebody. This is low hanging fruit as most operating mines already collect the data needed to better understand and management this critical issue, and in doing so gain practical insights into orebody variability to increase recoveries, reduce operating costs, improve stability through more reliable mine planning, and ultimately improve cash flow.

Simplistically, orebody uncertainty in a mining operation costs money in two ways. Firstly, it leads to incorrect decisions at all scales from short term tactical decisions to long term strategy. For example, if we consider a truck load of ore. If the estimated characteristics of the ore are exactly the same as the actual characteristics, the correct decision about where to send the truck is made every time. But uncertainty in the estimates means predicted and actual are rarely identical, so, even in today’s ‘digital mines’ many trucks are sent to the wrong destination. This means that ore that should go to the heap leach can be incorrectly sent to flotation or to the waste dump. The losses are not recoverable.

Secondly, uncertainty in the orebody leads to mismatches between plant operating settings and the characteristics of the ore feed. Correct settings continuously lag the presentation of the ore. Again, the losses are not recoverable. Inadequate geometallurgy is increasing cost and reducing metal production at mines every hour.

AMC SmartDataTM indicates that nearly two-thirds of mines fail to achieve budgeted metallurgical recoveries, and that those that underperform typically do so by 2 to 3%. Just achieving budget targets by uplifting recoveries would significantly improve to the bottom line.

Cut-off Grade and Strategy Optimization

Hill-of-ValueTM Strategy Optimization work conducted by AMC over the past 20 years has shown that by changing the cut-off grade policy mines can typically improve cash margins and overall project NPV by 30%.Sounds too good to be true? But it isn’t. So why aren’t more mines doing strategy optimization? The simple reason is that break-even grades are so entrenched in the industry there is great resistance to think differently. Nearly every mining course, and most of the text books we read, present a break-even formula as the way to calculate cut-off grade.

So what’s wrong with a break-even cut-off. Break-even’s are based on the economic theory that when marginal revenue and the marginal cost of production are equal, profit is maximized at that level of output. A typical break-even formula is shown. The problem is, for a typical mine, there are simply too many dependent variables that are linked to the cut-off grade, and the other key inputs can be highly variable.

A simple example in an underground mine is that the cut-off grade influences the mining shapes, which in turn impact the production rate, which affects the operating and capital costs. So, when you change your cut-off you also change your production rate and costs. We discussed some of the marco-economic challenges earlier, and just looking at the last five years, mines have experienced wide variations in prices, exchange rates and input costs. We also discussed the inherent variability in orebodies impacting recovery. These are factors miners have no control over. If we revisit the break-even formula it is clear that all the inputs can be either highly variable, are out of our control, or are dependent. Break-even is broken!

So what’s the answer. Understanding that you can’t calculate an optimal cut-off grade is the first step. And once that realization is made a whole range of opportunities open up. I will spare you having to read all the theory, and will summarize, that optimal cut-off grade is much more strongly related to capacity and the grade distribution of the mineralization, than to metal prices or costs. This is good news as we typically can’t control prices and we have limited control over costs, but we can control what we mine and at what capacity.

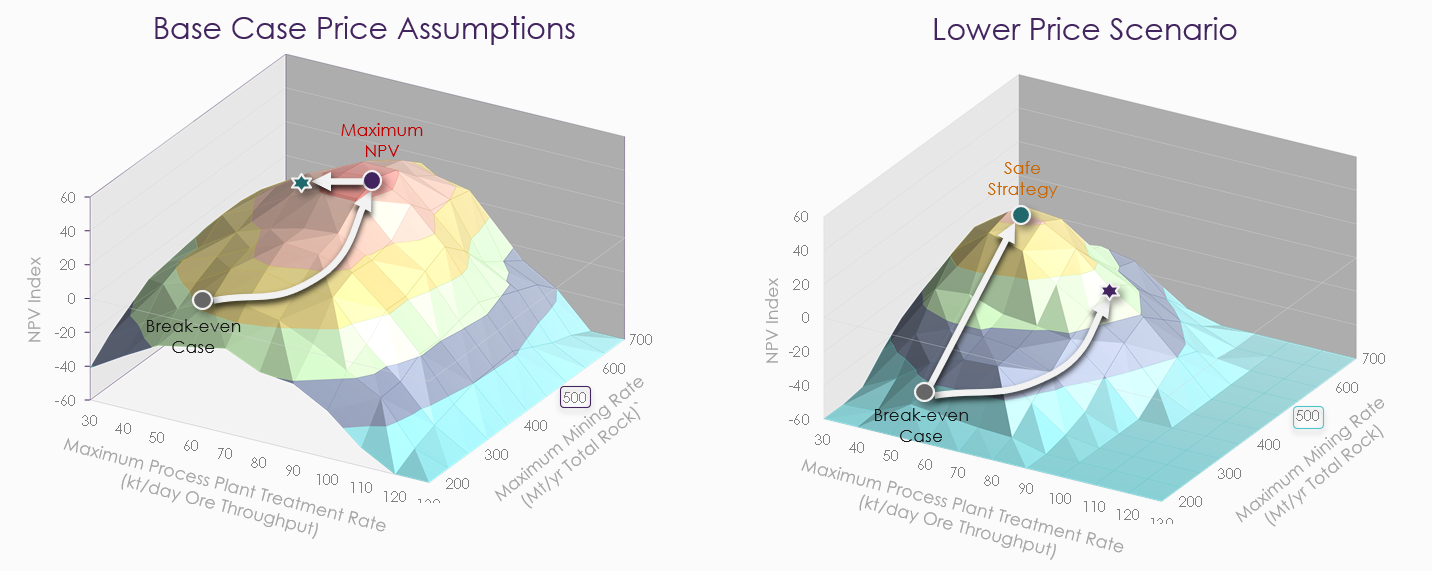

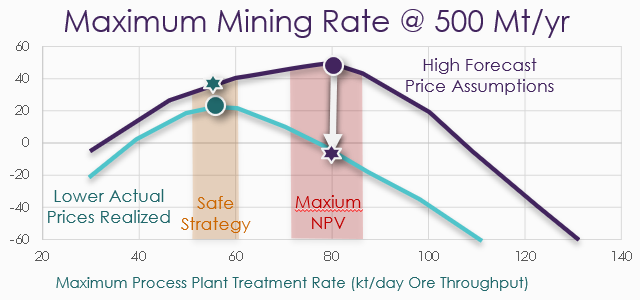

Determining the optimal cut-off grade requires the development of the value curves for each different option. This example shows an actual Hill-of-Value evaluation for an open pit mine with NPV on the vertical axis, and ore processing rate and total rock mining rate on the horizontal axis, at a constant cut-off grade. For this operating mine increasing the processing rate by 30% and doubling the mining rate, will substantially increase NPV and cashflow, at the particular price assumption used.

But understanding the shape of the curves is much more important than where the peak of the hill is, and here’s why. If we review the same options at a lower price scenario the shape of the hill changes dramatically as does the position of the peak. If we selected the options that maximized NPV at more aggressive prices it barely makes money. But if we selected the safe option, that is the option that maximizes NPV at conservative prices we still make good margins at the lower price, and we realize nearly all of the upside during higher prices. The HoV approach not only helps to maximize margins, but it enables the selection of a strategy that de-risks the mine.

HoV saves time and money by reducing the manual mine planning effort, and as all the potential options are considered, and they are evaluated for all scenarios, there is no rework or further investigation required at the back end of the study.

Getting the cut-off grade policy right is a significant lever in improving margins throughout the price cycle and de-risking the mine over the long-term.

Mine Planning

Good performance is about achieving a good plan. That is delivering the corporate strategy day in and day out.

Mine planning, when functioning well, pulls everything together. Strategy optimization can provide the right strategic direction but good mine planning materializes this in practice through practical and achievable mine plans that identify risks so they can be effectively managed, and opportunities for improvement incorporated. It should break the plan down to the right level of activities that can be executed by operations and align all key stakeholders. And finally good mine planning involves routine reconciliation and monitoring of compliance to ensure the operations stays on track.

In my opinion the most important KPI is spatial compliance to plan as nothing adds more value than close alignment between strategy and operations. But the opposite is also true. The biggest risk to most mines is misalignment between strategic intent and what is happening at the face. Unfortunately, this is all too common, driven by simplistic analysis and short-term thinking.

Good mine planning is essential to high performance as it balances the needs of ensuring future targets can be achieved with delivering on targets today. For example, we typically see significantly more excavator moves in open pit mines than planned due to a lack of orebody knowledge and grade control issues. Greater priority is placed on chasing metal today and the plan is ignored. This type of short-term thinking results in increased non-productive time and lost production that can never be recovered. A similar example in underground mining is congestion being a major impediment to productivity. The root cause is often a lack of timely waste development resulting in a small number of working areas so too many activities are happening in one place at one time creating a bottleneck to production.

Simply preparing and adhering to a good mine plan addresses most of the common operational issues and inefficiencies and facilitates high performance. So, making sure that mine planning is functioning well should be a priority for all mines.

Concluding remarks

In conclusion we, as an industry, are facing challenges and uncertainty, and this could last for some time. But there is significant opportunity to improve margins by repositioning operations and mining smarter. We need to make sure to focus on what matters and not what is easy to measure.

The five key levers where I see significant opportunities to sustainably improve margins are to avoid cost cutting and focus on cost management and control, set the right KPIs and get more out of the available production data, understand the orebody better through Predictive Geometallurgy, undertake Strategy Optimization and review the cut-off grade policy, and remember break-even is broken, and get mine planning in order so what’s planned gets done.

Those five levers provide a great opportunity to improve and sustain profit margins.

Want to learn more about how AMC can help you beat the price squeeze?

Subscribe for the latest news & events

Contact Details

Useful Links

News & Insights